National Australia Bank has been on a journey of technology transformation revamping its Digital Strategy. What does this mean to the digital strategy of NAB?

Backbase and IDC report recently noted, “three in five are likely to use banking offered by the neobanks by 2025“. By 2025, Australia will reach 90% of retail transactions through smartphones. So it is imperative the big banks up their digital game.

Forrester in its recent report analysing the big banks’ apps suggested the banks “Anticipate, not just meet customer needs“.

How are the big banks responding then?

The emergence of new players and further digital disruption in the industry puts 38% of traditional banks’ revenues at risk by 2025

Digital Banking – The Key Trends

- By 2025, Digital banking in Australia will reach 90% of retail transactions through the smartphone

- Small and mid-tier banks will be challenged by a combination of legacy systems, lack of digital talent, and lack of experience in executing large-scale digital transformation

- 80% of banking assets in Australia will still be dominated by the Big 4

- 35% of IT budgets among Tier 1 and Tier 2 banks will be spent on “new” ― new technologies and new categories of spending. There will be a growing challenge in integrating these with legacy systems

For details check the ITVibes recommended reading here.

Also Read: Understanding the Digital Strategy of Commonwealth Bank of Australia

NAB Digital Strategy

The Five Focus Areas

CEO Ross McEwan listed the top five top areas of focus in the December 2019 AGM.

In a message emphasising the importance of technology, Mr McEwan highlighted on the need for a “Digital Strategy to provide the best digital and mobile services to be competitive.

Otherwise, we will be left behind by new tech-driven financial service providers“.

In line with the Ross strategy, NAB announced org structure changes focusing on the critical elements of its business.

Mr McEwan’s five focus areas for NAB:

- Safe and Secure

- Get the Basics Right

- Employee Delight

- Easy to Do Business

- Growth

Also read: The 3 trends shaping the future of digital banking

NAB Digital Strategy accelerates shift from in-person banking to Online

COVID has accelerated the transition from in-person banking to Online banking. So did NAB’s digital focus.

Deploying digital tools to support banking, NAB announced small regional branches would be open only from 9.30 am until 12.30 pm. All support outside this period would be via digital and phone banking.

“It is clear the face of banking is changing, especially in the way customers want to interact with us,” NAB Exec Ms Rachel Slade said.

Key statistics supporting the shift to the online/digital model:

- Over 90% of NAB’s customer interactions are now taking place online or by phone

- More than 50% of customers log into NAB digital banking via the app or online

- Over-the-counter transactions have reduced by 25 per cent in the past year

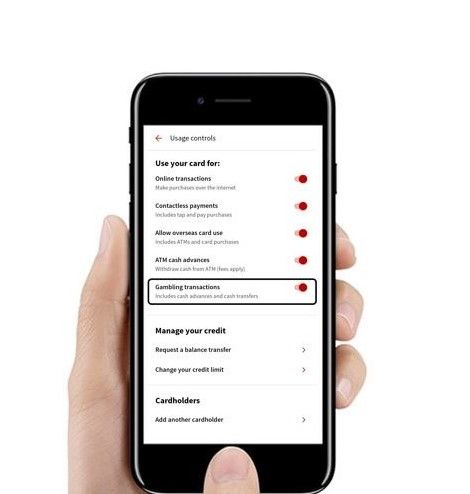

NAB Digital feature to restrict gambling transactions

The First Bank in Australia

Earlier this year, NAB provided its customers with the option to block gambling transactions via the mobile app. Although the feature was available to iOS users in Dec 2019, Android users got the option in February 2020.

The latest NAB digital feature has gained acceptance with over 50,000 customer activations in the initial months.

The tool is designed to put the choice in the hands of our customers

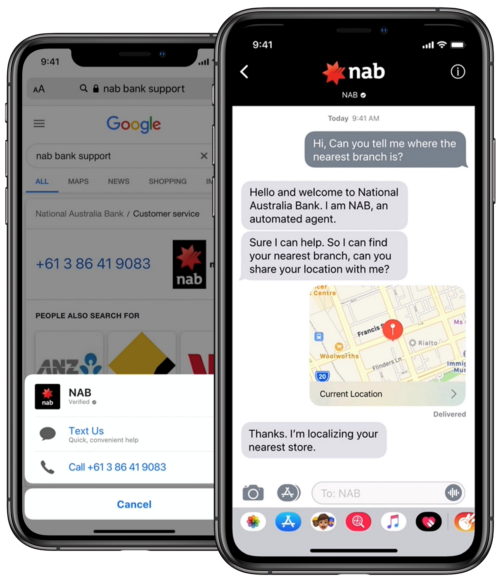

New-age digital support to improve customer experience

NAB digital strategy to improve NPS

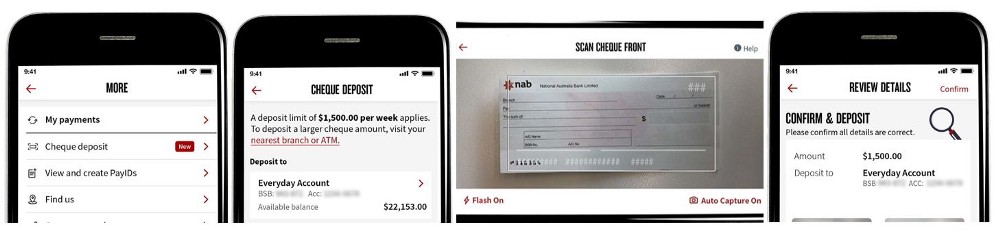

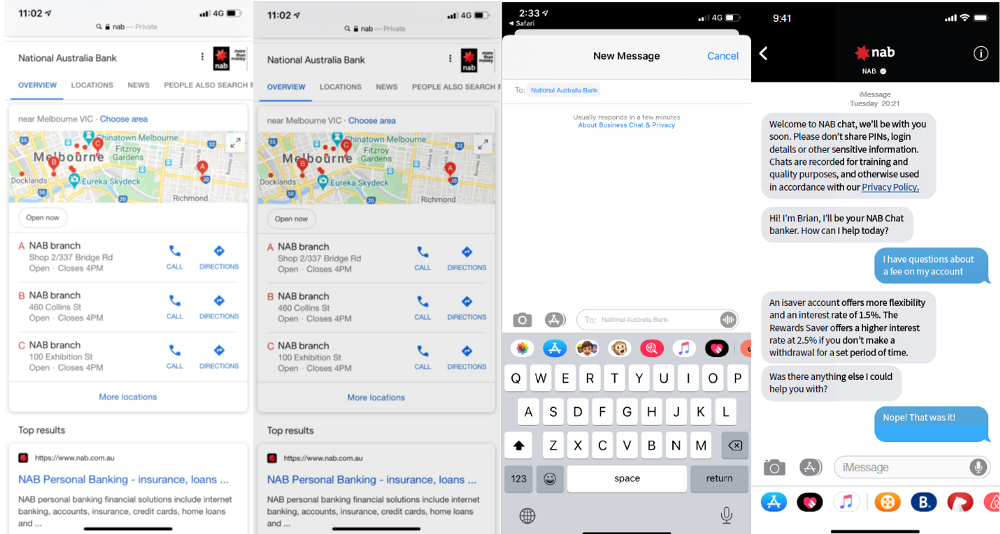

NAB announced a range of digital initiatives aimed at improving customer experience:

Online cheque deposit

iMessage Chat Support

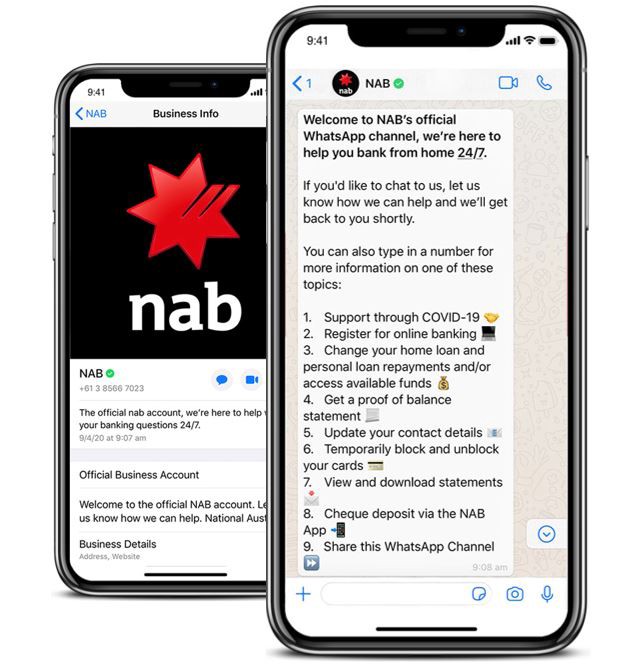

Whatsapp chat support

Also read: Digital Banking Market shifts towards AI, cloud and secure banking

Voice recognition authentication

Over 250,000 customer enrolments

As the first major Australian bank to launch Voice Recognition Authentication, the NAB Digital strategy is aimed at improving customer experience.

Nuance Communications, the solution provider said its biometrics solution powers NAB’s VoiceID service. This authenticates customers’ voices in seconds.

This could prevent fraudsters from accessing bank accounts using a customer’s credentials.

NAB joins the growing list of leading enterprises successfully leveraging biometric solutions. These include The ATO, HSBC, RBS, TalkTalk, Vodafone Turkey and Deutsche Telekom.

Last year, NAB trialled Face Recognition technology partnering with Microsoft. The pilot was aimed at helping customers access ATM transactions by removing dependency on cards. The project didn’t take off beyond the pilot stage. However, NAB has signed a five-year partnership with Microsoft in its multi-cloud journey.

NAB Workplace technology turbo-charged by COVID-19

NAB’s technology shift to the cloud has also enabled its workplace transformation. NAB revealed on its official tech blog that “thousands of call centre employees who couldn’t work remotely in the pre-pandemic days are now working from home.”

Thousands of call centre employees who couldn’t work remotely in the pre-pandemic days are now working from home

NAB revealed Facial Recognition would be coming to a NAB work laptop in 2021 with Windows Hello.

Crediting its cloud-first digital strategy, NAB highlighted several milestones and projects underway:

- Introduction of collaboration platforms such as Microsoft 365 Teams, OneDrive and Zoom

- Token-based remote access

- Introduction of Zscaler Private Access

- Cloud-driven zero trust architecture which eliminates legacy

- The rollout of Windows 10 to almost all Head Office staff

Also read: Commbank introduces a Digital Feature that Predicts Future Bills

Partnership with Pollinate to bring insights to small businesses

As the largest lender to small and medium businesses, NAB carries the highest risk due to COVID economic pressures.

Aimed at bringing new insights and savings to small businesses, NAB announced a partnership with Pollinate becoming the second bank to partner with Pollinate. NAB said it’s targeting a pilot in March 2021 ahead of rolling out the technology across its customer network.

Likened to internet banking for merchants, Pollinate provides sales analytics to SMEs at their fingertips.

The partnership with Pollinate is designed to deliver real-time insights to help them better manage and grow their businesses

NAB is the second bank to join the Pollinate network, together with NatWest. The platform was launched by NatWest as Tyl in the UK in September 2019.

For more details of the partnership, check out this report.

Recommended read: Reserve Bank of Australia partners with NAB, CBA, Others on Central Bank Digital Currency Project Using Blockchain

NAB launches Cyber Bug Bounty Program

Claiming bragging rights as the first of its kind in Australian banking, NAB launched a bug bounty program in partnership with crowdsourced security company Bugcrowd.

NAB announced to reward vetted security researchers who uncover “previously undisclosed vulnerabilities” in NAB’s environment.

Brings together uniquely skilled testers and security researchers with fresh perspectives to uncover vulnerabilities in our defences

Nick McKenzie

Highlights:

- Bug bounty program launched in partnership with Bugcrowd

- Participants must have an ‘Elite Trust Score’ on the Bugcrowd platform

- Bank will reward researchers who uncover previously undisclosed vulnerabilities

Also read: Gartner Predicts 40% of Boards Will Have a Dedicated Cybersecurity Committee by 2025

NAB’s Five-year partnership with Microsoft

Targeting 80 per cent of the apps on the cloud by 2023

Highlights:

- NAB will be using Azure as its primary cloud for the next 1,000 apps

- To share development costs and resourcing investment

- NAB had already moved more than 800 apps to public cloud providers

- Apps on the public cloud will move from one third to around 80 per cent by 2023

- Aware of the international impact it promises, Microsoft’s global engineering team is supporting the program

- Microsoft will also train 5,000 NAB and BNZ technologists as part of the NAB Cloud Guild program

Even though a latecomer to the shift to cloud underway at NAB, Microsoft has taken an important position in the bank’s cloud migration journey.

As digital banking in Australia matures, both Big Tech and Fintech are taking decisive steps. This is eroding the customer base of established players.

Although NAB has been on a technology transformation journey with the shift to cloud, Microservices architecture, application portfolio optimisation, simplification among others, the question remains: Is this enough?

In the next part of the series, we explore the CBA Digital Strategy.