Highlights

- Banking transformation accelerated by new technologies over the next 5 years

- Artificial intelligence will separate the winners from the losers

- The coming overhaul of business models to create digital ecosystems

With COVID accelerating the need for new technologies, the banking industry is undergoing a tectonic shift to the digital business model. The latest Temenos-sponsored survey interviewing over 300 banking executives reveals fascinating insights into the trends shaping the future of digital banking.

CEO of Temenos Max Chuart listed the top three trends shaping digital banking in a World Economic Forum post.

Cloud and SaaS top banking technologies’ demand

Majority of respondents to the survey (66%) cited new technologies as having the biggest impact in banking over the next five years. One technology which has seen increased demand both from new entrants and established banks is Cloud and Software as a Service (SaaS).

84% of respondents believe that Cloud technology will be transformative in banking

Cloud featured in the top three technology investment priorities, with more than a quarter of executives naming it as a priority focus. Recent Gartner survey forecast cloud spending to increase by 19% in 2020 despite decreasing IT budget.

Also read: U, V or W? Economic recovery uncertain: NAB CEO

The game-changing Artificial Intelligence Imperative

The Temenos-EIU survey noted “Of all advanced technologies, banking leaders strongly believe (77%) that Artificial Intelligence (AI) will be the most game-changing.

Bankers see a diverse range of uses for AI with “customer experience through personalisation” as a top priority. Many banks also see the potential for AI to support new business.

Developing AI platforms was the focus of technology investment for 33% of executives globally. This was second only to cybersecurity – an unsurprising leader, given widespread concerns about data breaches and cybercrime.”

Banking services themselves didn’t change, only the method of access.

Also read: Digital Banking: Market shifts towards AI, cloud and secure banking

Banks will overhaul their business models to create digital ecosystems

The survey revealed more than 80% of respondents believe that banking will become part of a platform of services. And 45% are committed to transforming their business models into digital ecosystems and making the bank the centre of these platforms.

“While mobile brought banking into everyday lives, ecosystem model integrates our everyday lives with banking. They bring many key elements of modern banking technology – such as cloud, explainable AI, and open APIs – together into one seamless user journey.”

Digital transformation is beginning to change business models in banking.

Success Stories

Temenos CEO listed the success story of Partners Federal Union which serves the Walt Disney Company.

Partners developed an app that offers core banking, coupons from local merchants and an education portal where members can enhance their money management skills.

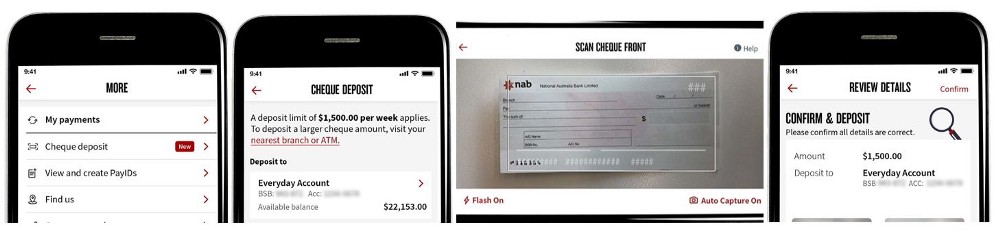

New features include mobile check cashing, where image recognition and verification technology allows members to make deposits directly from their smart devices. A similar feature was enabled by the Melbourne-based National Australia Bank allowing its customers to deposit cheques via app.

After launching the app, Partners added users each month, resulting in a 20 per cent increase in remote deposits and a 64 per cent increase in mobile card payments.

Back in February this year, Bank of Queensland announced its decision to invest in digital technologies with an aim to become a neobank.

Backbase report revealed three in five are likely to use digital banking offered by neobanks and challenger banks by 2025. Digital transformation is a necessity for banks in the new world.

As the CEO of Temenos says “With the right strategy, banks have a unique opportunity to succeed in the long term. Pursuing advanced technology and digital ecosystems will be key to that success”. We agree. Are big banks listening?