National Australia Bank announced a series of digital services, some Australian banking first. Elevating its positioning and attempting to differentiate itself from its peers, NAB has offered new features aimed at improving customer experience.

The new features announced reveal the bank’s direction in line with the “Ross Strategy”.

- Whatsapp support channel

- Voice ID Based biometric authentication

- iMessage chat support

- The new options are in addition to the app features provided last year:

- Online cheque deposit feature

With NAB’s Net Promoter (NPS) rating still negative, new-ish boss Ross McEwan made changes to the organisational structure of the bank “designed around the customers” after announcing five focus areas in his first AGM.

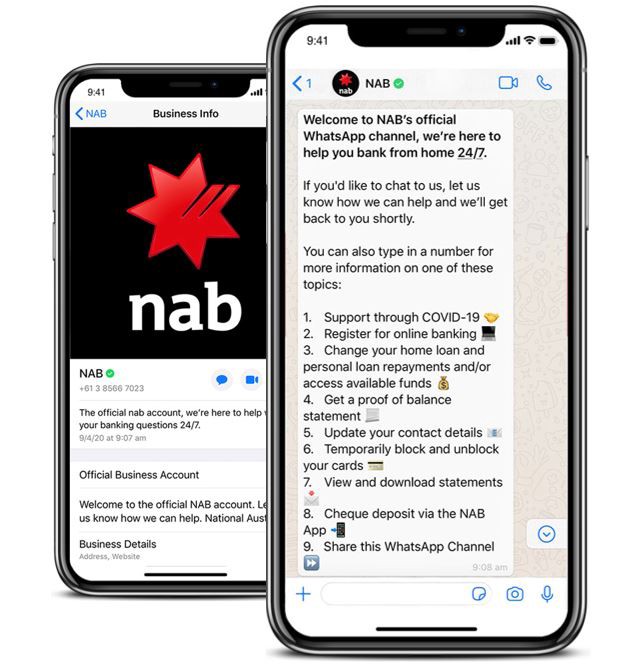

Whatsapp support channel – with a bot

This is the first time NAB digital strategy is leveraging a popular messaging platform. Whatsapp has over 8million active users in Australia making it an attractive platform for customer interactions.

NAB customers can access information and FAQs over Whatsapp integrated with the bank’s support system.

Interestingly, NAB has implemented a bot that responds to customers’ questions.

The head of social media at NAB Reveka Katakis said on the banking giant’s medium blog post: “Customers can interact with the bot to get instant answers about how they can self-serve online.”

Voice ID – First major Australian bank to offer VoiceID based authentication

With the ubiquitous presence of password managers, the importance of remembering passwords is already on the decline. NAB’s new feature could accelerate this further.

Here’s how it works:

- Customers will be asked if they would like to register their voiceprint when they call NAB contact centre.

- VoiceID is an optional service

- If a customer opts in to use the service, the next time they call NAB, the authentication system will recognise the voice based on the saved voiceprint.

- The security could be further beefed up to repeat a passphrase instead of entering a password!

The new feature will make passwords a thing of the past.

Voice ID saves customers’ time | NAB Spending less time on the ID Process

While many enterprises are offering self-serve, chat support and other support channels, there’s still a large number of calls addressed by contact centre staff.

Enterprises are pursuing a digital-driven simplification strategy to reduce complexity and the number of calls placed to contact centres.

Telstra revealed reducing the number of calls to contact centre by 19 million since 2016 (about 50%).

In comparison, NAB contact centre handles about 5 million interactions over phone.

“This technology is helping us improve the experience our customers have when they call by spending less time on the ID process and more time helping them with their needs.”

Paula Constant, Executive General Manager Consumer Direct

“This technology has been crucial in the last few weeks (during the COVID pandemic) to be able to speed up the authentication process for the thousands of customers that have called us for assistance”, says Paula Constant, Exec GM Consumer Direct.

The time consumed to authenticate a customer has been reduced from a few minutes to seconds, improving customer experience leading to a more personalised experience and better security”.

Secure

NAB stated the voiceprints are encrypted and stored in a secure database in the NAB environment.

Voiceprints are a mathematical representation of the biometrical and behavioural features of a voice; a series of numbers which would not allow anyone to reconstruct an actual voice.

At this stage, Voice ID is only available for personal customers calling NAB’s consumer contact centre but the bank announced this would be available for business customers as well. NAB revealed signing up about 100,000 customers to Voice ID.

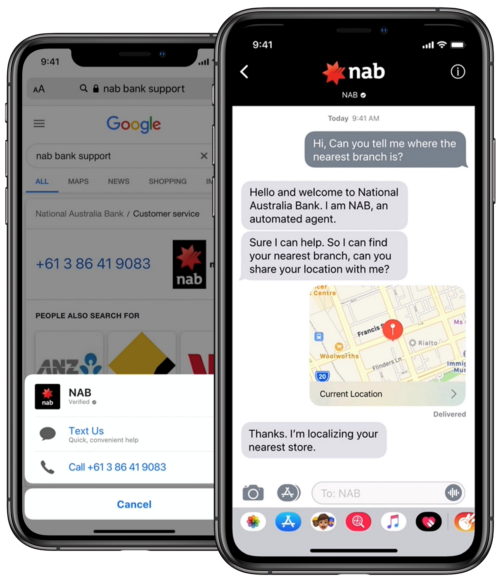

The ABC of support – iMessage

The Apple Business Chat (ABC) is a service offered by Apple for iOS users to easily communicate with the bank via their iMessage app to support simple servicing needs.

Claiming to be the first bank in Australia, NAB revealed launch of iMessage support for customers. The option would be useful to those who prefer chat option.

NAB revealed the option has been used by its customers to get a number of COVID-19 related questions answered, proving its effectiveness as a customer support option.

Value-Added Services

The big banks are facing the threat of fintech disruption as well as the Big Tech at their doorsteps chipping away traditional banking revenues. The neobanks have been appealing to new customers with attractive interest rates and compelling value propositions eroding customer base of big banks.

Although established banks have huge customer deposits running into hundreds of billions, the big players are cognizant of the speed at which the challenger banks are growing their deposits with attractive interest rates on offer. Australian neobanks 86400 and UP offer interest rates far higher compared to NAB’s offers.

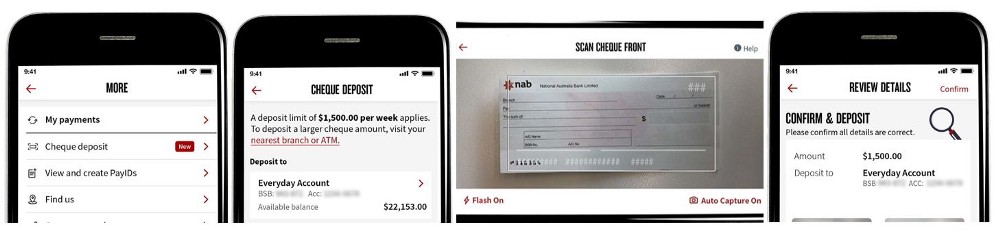

NAB has been adding additional features to its banking app for some time now.

NAB provided a feature to deposit cheques online. The feature offered the customers to take a photograph of the cheque and deposit to their account via the NAB app. The feature launched in August 2019 has enabled over 100,000 cheque deposits using the app.

Earlier this year, NAB also offered a digital option to restrict gambling transactions on the iOS app. The welcome feature offered customers to have better control over their finances.

In response to fintech disruption, established players have been offering new features to retain customers and appeal to the younger generation. The new features offered by NAB are a step in that direction. The question still remains: Is this enough?