In this part of our series on digital banking in Australia, we unbundle the CBA Digital Strategy. Australia’s leading bank CBA has further cemented its position as the Overall Leader in Digital Banking among the big banks.

Read our special report on the NAB Digital Strategy here

Digital Transformation key part of CBA Strategy

Highlighting the importance of digital technology, the CBA boss said: “A big part of our strategy is delivering exceptional customer service, but also doing with leading technology.

And it’s not just about the digital experience, it’s about a real-time and high availability system”.

At the recent AGM, Mr Comyn said “Our strategic priority is to simplify our business and be the best in digital banking”.

Our continuing investments in digital innovation are setting us apart from our competitors and helping us deliver richer and more personalised digital banking experiences and services

Matt Comyn, CEO Commonwealth Bank of Australia

6 areas to extend “digital leadership”

Revealing its six strategy areas to “extend digital leadership”, CBA committed to simplify and reduce app footprint while enhancing customer experience across business channels.

- Personalisation

- Integrated Digital Experiences

- Digitising end-to-end

- Intelligent Protection

- Resilient, modern platforms

- Globally leading capability

Recommended read: The Future of Data and Analytics, according to Gartner

CBA Investing in Digital Technologies to enhance business strategy

“We are investing in our business and institutional banking experiences through enhancements to our service, data and technology capabilities”, said Mr Comyn.

“These include improving and extending BizExpress, our same-day business lending facility.

By quickly deploying BizExpress we were able to accept applications the day after the Government had established the Coronavirus SME Guarantee Scheme”.

Home Lending is now 80% digital end to end using PEXA on the back end with continued Investments in business underwriting processes.

CBA also announced big investments in Institutional banking division – investments in the underpinning infrastructure and systems, everything from the KYC onboarding process to the institutional lending system.

Also read: Three in five likely to use digital banking offered by neobanks and challenger banks by 2025

Simplification a key element of CBA Digital Strategy

The bank’s execution priority is to deliver a simplified bank while becoming the best in digital.

Data reveals the impact: A whopping 64% of total transactions (by value) are digital, although a moderate increase compared to the previous year.

The Simplify technology initiative focuses on a “simplified IT architecture and reduce the unit costs of technology”.

The goal is to make it simple for customers to bank with CBA delivering digitisation benefits. To this effect, CBA has partnered with leading global players including Microsoft.

We are investing in our Business and Institutional Banking experiences through enhancements to our Service, Data and Technology capabilities

Too Much Infrastructure: Aiming to reduce the number of apps running on “too much infrastructure”.

Of the about 3,500 applications, CBA aims to reduce the footprint down by 25% as a part of its simplification-driven digital strategy

Announcing FY20 results, CBA advanced digital plans with simplification agenda targeting over 95% on cloud in 5-7 years.

This is in line with the bank’s strategy of becoming a “simple bank” while embracing the cloud paradigm. A major cloud migration program is underway and CBA aims to achieve about 95% on the cloud.

The Cloud target and trajectory are similar to other banks’. NAB is on a tech transformation program embracing cloud while Macquarie bank has targeted 100% on the cloud by FY 22.

Also read: Digital Banking shifts towards AI, cloud and secure banking

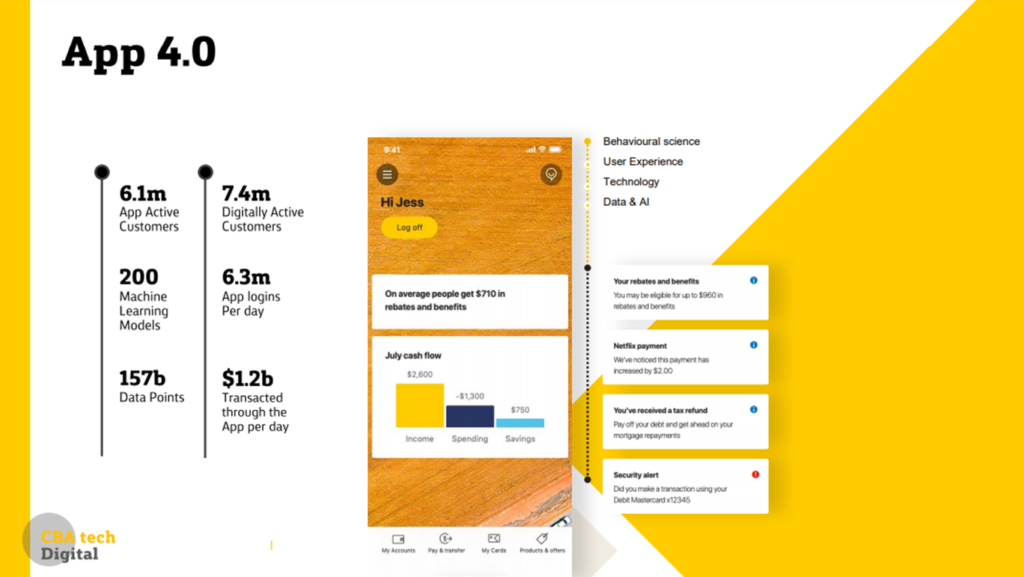

App 4.0: 7.4mn “digitally active” customers, supported by 200 Machine Learning Models

CBA claims to have 6.1 million “App Active” customers.

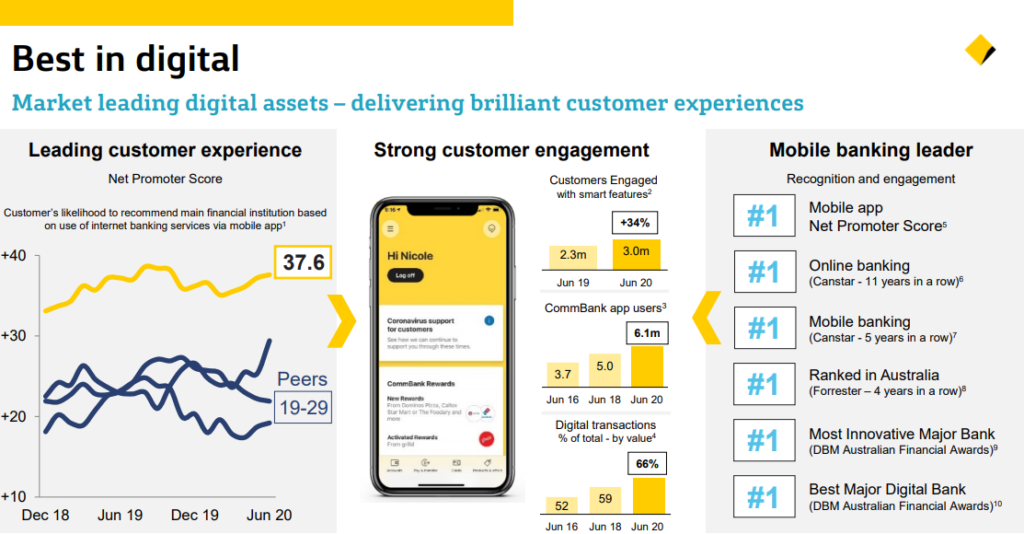

CBA digital strategy wins accolades from Forrester: “The best in Digital Banking Experience”

Our continuing investments in digital innovation are setting us apart from our competitors and helping us deliver richer and more personalised digital banking experiences and services, declared Mr Comyn.

Forrester seems to be in agreement.

The leading analyst recently rated “CBA as the overall leader in digital experience among the four big banks.

Rating CBA highly for “delivering impressive digital experiences“, Forrester called upon Australian banks to “not just meet, but also anticipate customer needs.”

The report states, “CBA takes the lead by delivering impressive digital experiences, excelling at both user experience and functionality.”

CBA is the leader in usability, functionality, and overall digital experience for the fourth consecutive year

Forrester report

Also read: The Top 3 Trends of Digital Banking

Partnerships Strategy and Startup Investments to augment Digital Value Proposition

CBA has been on a mission to build new partnerships, expand existing investments and leverage the power of fintech and the wider startup ecosystem.

x15 ventures is CBA’s investment arm building a portfolio of new digital businesses.

Commbank aims to “combine the agility of a start-up with the support and reach of the Bank, all to better serve our retail and business customers”.

With x15ventures CBA is “Building the next generation of solutions for 15 million customers, by unlocking new value from CommBank’s assets through a partnership with the tech and innovation community”.

The initiative has over 25 ventures adding 3m+ customers. x15 has launched four ventures, including Vonto. The latest acquisition is Doshii, the cloud platform for the hospitality industry.

CBA noted its Klarna partnership has over 270,000 downloads with leading merchants onboard including Kogan.com.

The Future of Digital Banking

Recent Ovum report on Digital Banking noted “market shifting towards AI, cloud and secure banking“.

The latest Temenos-sponsored survey interviewing over 300 banking executives revealed the top three trends shaping the future of digital banking.

Cloud, SaaS and the game-changing AI are the key trends to watch out for in the banking sector.

The CBA strategy seems to be aligned with the trends shaping the industry.

Coming Up

In the next part of our series on Digital Banking, we focus on ANZ Group Digital Strategy. Stay tuned!

ITVibes Recommends:

Check out this video on the future of Digital Banking in Australia