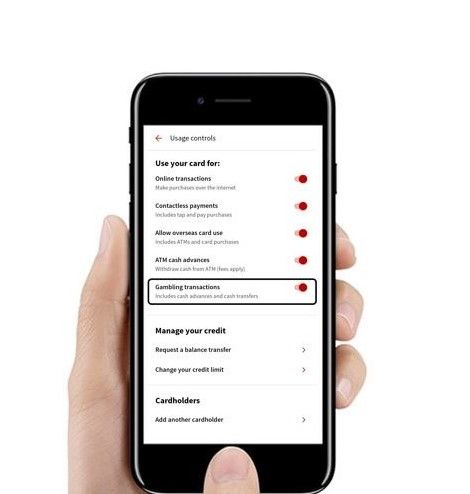

Earlier this year, National Australia Bank provided its customers with the option to block gambling transactions via the mobile app. Although the feature was available to iOS users in December 2019, Android users got the option in February this year.

The new feature was welcomed by customers and industry observers alike.

The First Australian Bank

NAB announced a key milestone today – Over 50,000 credit card and debit card activations since the launch.

“In February this year, we became the first Australian bank to offer our customers the option to block gambling transactions via our app – with just one touch”, said Rachel Slade, the Group Executive Personal Banking NAB in a LinkedIn post.

“The tool is designed to put the choice in the hands of our customers.”

Also read: NAB digital strategy and transformation journey

Value-added services

With the neobanks offering attractive interest rates and ‘Big Tech’ spreading tentacles across financial services, it’s imperative the established players do more to improve brand loyalty and retain customers.

Offering existing customers with personal finance management tools and better support options is one growing trend. NAB’s latest feature empowering customers to control their finances is a step in that direction.

Although big banks have huge customer deposits running into hundreds of billions, the established players are cognizant of the speed at which the challenger banks are growing their deposits with attractive interest rates on offer.

Also read: Don’t Just Meet, Anticipate Customer Needs: Forrester Review of Australian Banking Mobile Apps

NAB digital strategy to enhance customer experience

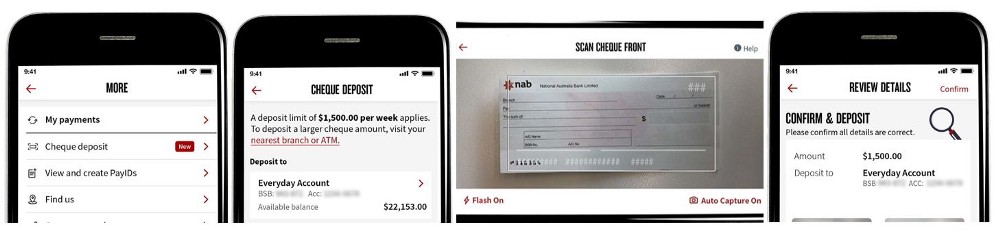

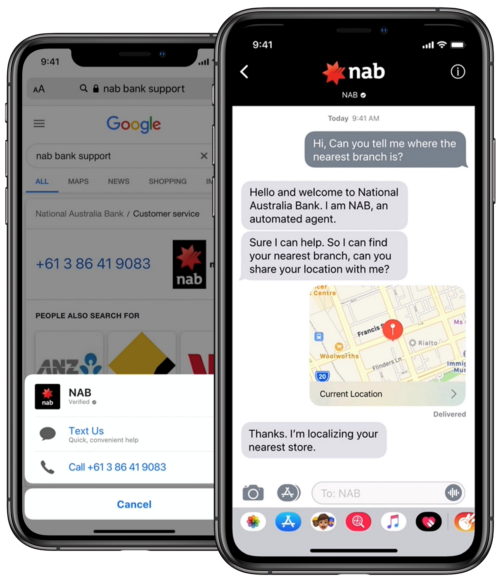

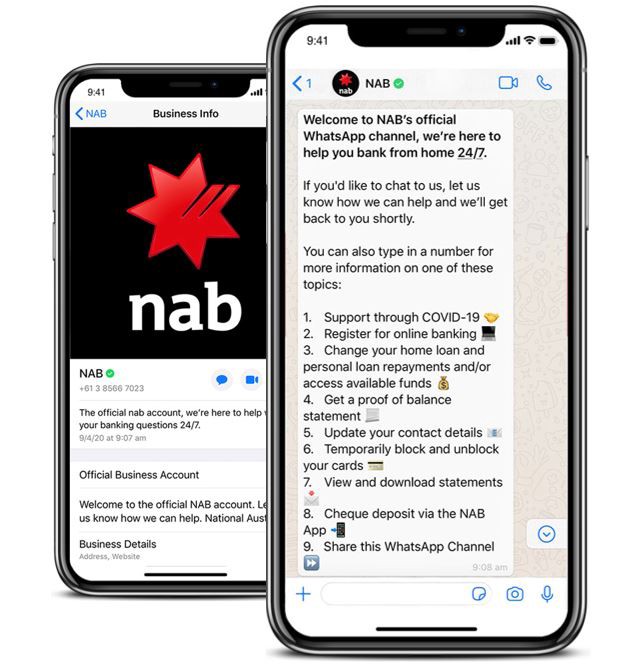

In his first appearance after taking over as the CEO, Ross McEwan listed five focus areas for NAB in December 2019. In line with this strategy, NAB announced a range of digital initiatives aimed at improving customer experience:

- iMessage and Whatsapp chat support

- Online cheque deposit

- Voice ID biometrics to improve contact centre experience

- NAB Digital option to restrict gambling transactions

With NAB’s Net Promoter (NPS) rating still negative, Mr McEwan made changes to the organisational structure of the bank “designed around the customers” after announcing five focus areas in his first AGM.

Forrester in its latest review of the big four banks’ mobile banking apps recommended the banks to anticipate customer needs, not just meet the needs. Forrester also rated CBA as the digital banking leader in Australia, ahead of NAB and other peers.