Highlights:

- Small regional branches to work from 9.30 am until 12.30 pm

- Digital and Phone support outside this period

- Over 90% of NAB’s customer interactions are now taking place online or by phone

- More than 50% of customers log into NAB digital banking via the app or online

- Over-the-counter transactions have reduced by a quarter in the past year

NAB announced changes to banking in small regional branches acknowledging the market shift to digital banking. Deploying digital and phone support, NAB claimed the new model would still see hundreds of jobs maintained.

The shift would affect small regional branches which would be open only up to 12.30 pm for in-person banking, support outside these hours would be by phone and online chat.

“It is clear the face of banking is changing, especially in the way customers want to interact with us,” Group Executive Personal Banking Ms Rachel Slade said.

“Our colleagues will learn new skills to support customers in new ways, including on the phone and online chat, which presents the opportunity for our bankers to work remotely”.

Also read: The 3 trends shaping the future of digital banking

ITVibes Insight:

With the neobanks offering attractive interest rates and ‘bigtech’ spreading tentacles across financial services, it’s imperative the big banks do more to improve brand loyalty and retain customers.

Backbase’s report on digital banking reveals the digital disruption in the industry puts 38% of traditional banks’ revenues at risk by 2025. Also, three in five are likely to use digital banking offered by neobanks and challenger banks.

Offering existing customers with personal finance management tools is one growing trend to retain customer base.

Forrester in its latest review of the big four banks’ mobile banking apps recommended the banks to anticipate customer needs, not just meet the needs. Forrester also rated CBA as the digital banking leader in Australia, ahead of NAB and other peers.

Also read: ITVibes insights on NAB digital strategy and transformation journey

NAB Digital strategy to improve customer experience

National Australia Bank has been on a technology transformation journey adopting cloud and focusing on customer journeys.

With NAB’s Net Promoter (NPS) rating still negative, Mr Ross McEwan made changes to the organisational structure of the bank “designed around the customers” after announcing five focus areas in his first AGM.

In his first appearance after taking over as the CEO, Mr McEwan listed five focus areas for NAB in December 2019. In line with this strategy, NAB announced a range of digital initiatives aimed at improving customer experience:

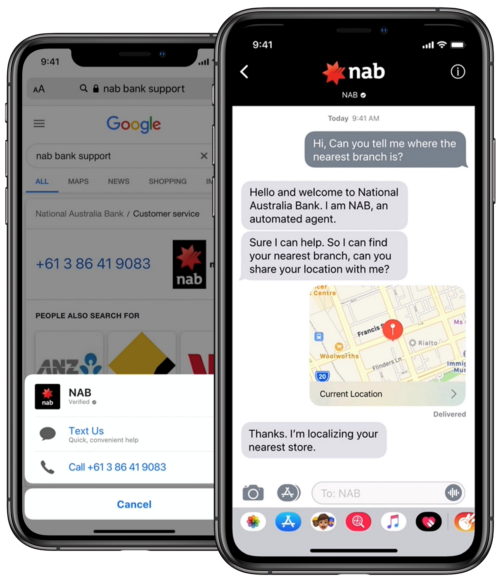

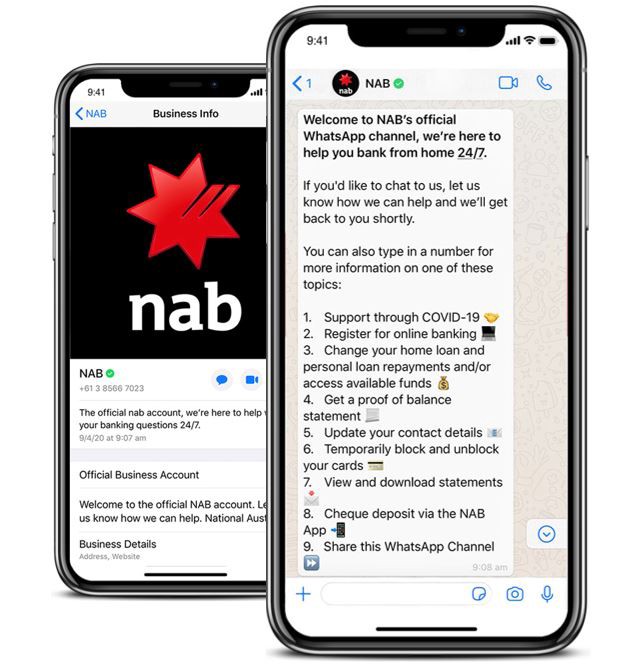

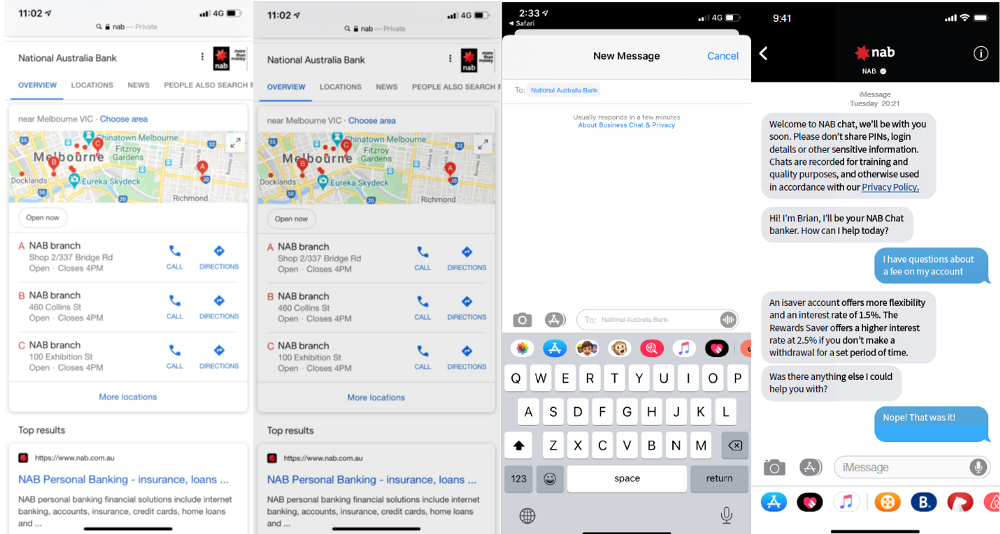

- iMessage and Whatsapp chat support

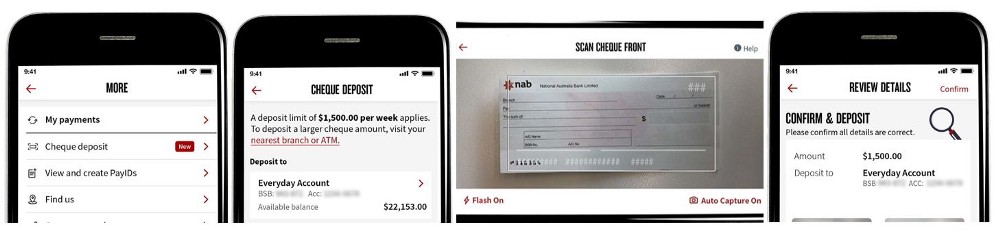

- Online cheque deposit

- Voice ID biometrics to improve contact centre experience

- NAB Digital option to restrict gambling transactions