CBA today announced strategic partnerships to help deliver new digital banking services leveraging next-gen technologies. Commbank committed US$10 million technology investments to support the sourcing, scaling and financing of local fintechs, as well as the development of emerging artificial intelligence businesses in Australia.

Commonwealth Bank’s venture building entity, X15 Ventures announced its fourth new venture Backr which offers a digital, task-based approach to starting a small business. The Backr proposition is to provide businesses with everything they need to hit the ground running.

As Australia’s leading technology bank, our role is to combine exceptional service with the very best digital experiences and technologies

Matt Comyn, CEO

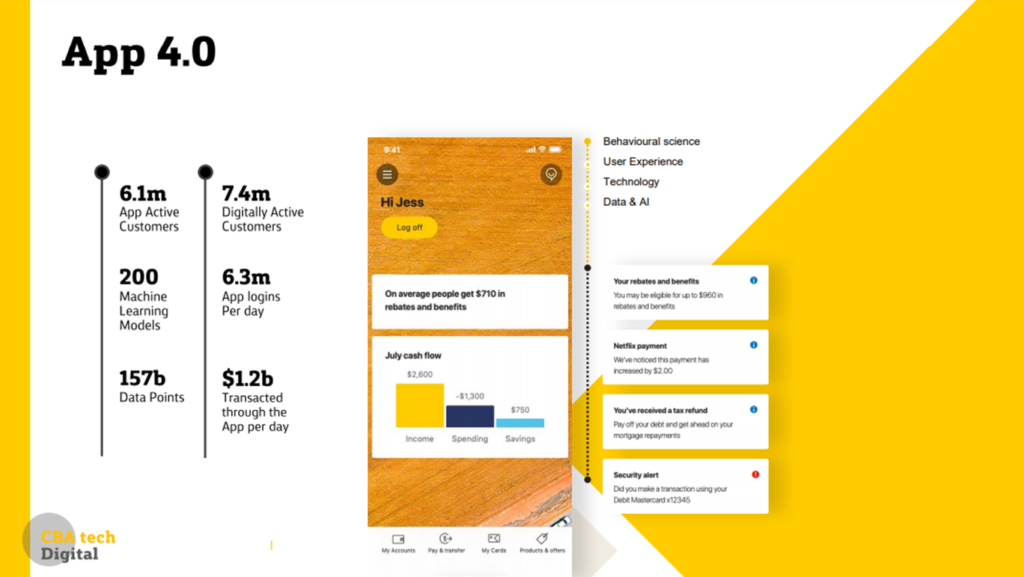

CBA Digital Banking continues to grow

CBA digital banking numbers which continue to grow.

- Over 6.1 million customers using the CommBank app

- Increase of 0.5 million from FY19

- More than $1.2 billion transacted through the app daily

- Daily logins surpass 6.3 million

- Combined with the Group’s online banking platform, NetBank, digital daily logins rose to a record 10.2 million at the height of the COVID pandemic

- Since the start of the pandemic, over 7 million customers connected through the CommBank app

Highest rated digital banking app among big four banks

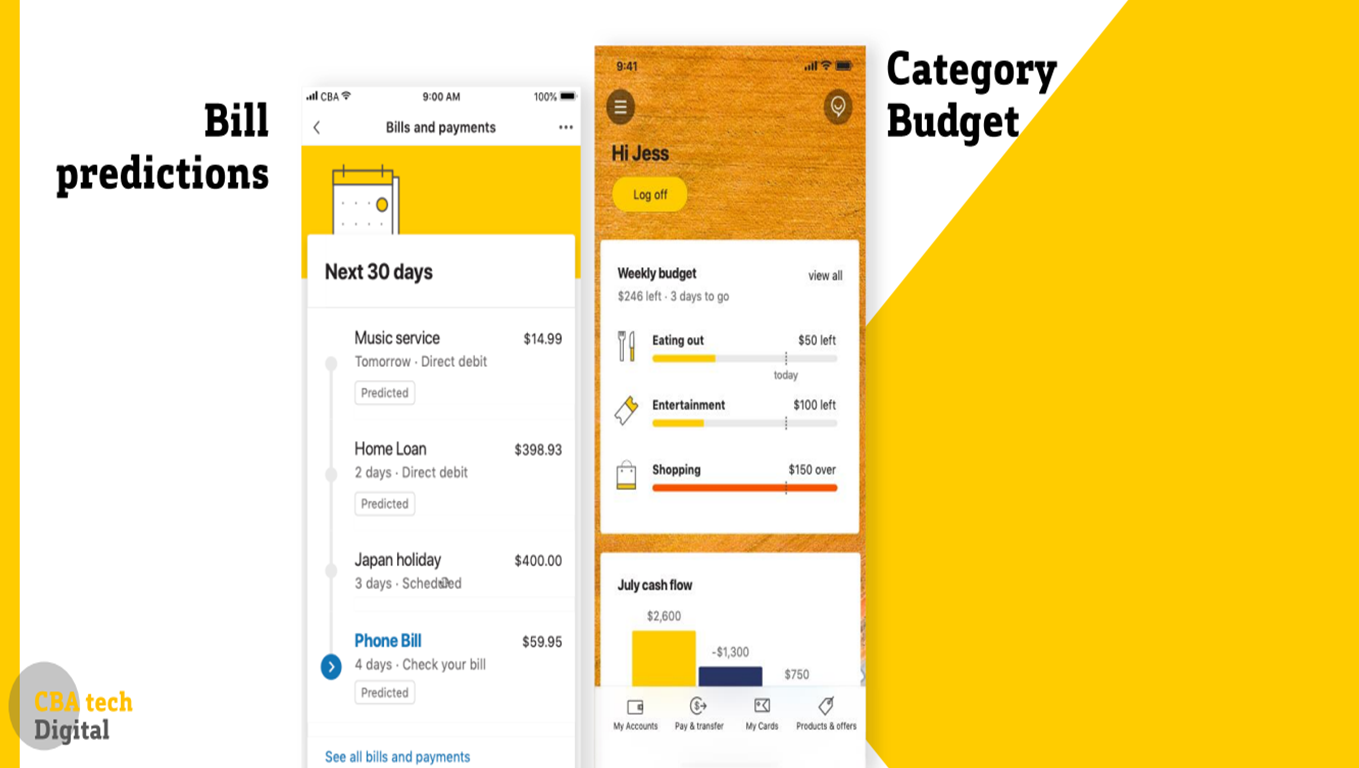

Forrester’s latest report on Australian Mobile Banking apps has rated the CommBank app as the overall leader in digital experience for the fourth consecutive year. The report stated, “CBA takes the lead by delivering impressive digital experiences, excelling at both user experience and functionality.”

The best mobile banking experiences don’t just meet customer needs with strong features and easy-to-use apps, they also anticipate customer needs, Forrester noted.

Growing Klarna partnership

CBA’s reach has extended further in Australia with the Klarna partnership launched in January this year. Committing to increasing the pace of innovation, Mr Comyn had said the Klarna partnership would bring “exciting payment propositions” to bank customers.

Klarna, one of the leading digital payment providers, has over 80 merchants now live on the platform with over 270,000 Australians downloading the app.

The Buy Now Pay Later (BNPL) sector has seen significant growth despite COVID.

In June, Klarna announced a customer base of 7.85 million US customers. The growth was driven by apparel, beauty and footwear brands partnering with Klarna to offer their customers flexible BNPL options.

In comparison, Afterpay clocked 5 million active users in the US. Recently, Afterpay revealed substantial investments from Tencent.