National Australia Bank’s shift to Cloud has enabled its workplace transformation, noted the NAB Technology team on its official tech blog. Thousands of call centre employees who couldn’t work remotely in the pre-pandemic days are now working from home in a rapid shift to remote working model, revealed the blog.

NAB technology initiatives in 2021

Cloud-first strategy

Nearly 85 per cent of employees are working from home starting in March, increasing from the pre-COVID average of 13 per cent

Crediting its cloud-first strategy, the NAB technology team highlighted several milestones and projects are underway:

- Introduction of collaboration platforms such as Microsoft 365 Teams, OneDrive and Zoom

- Token-based remote access

- Introduction of Zscaler Private Access; Cloud-driven zero trust architecture which eliminates legacy

- Rollout of Windows 10 to almost all Head Office staff (with the upgrade for Branch staff underway)

Windows Hello

Facial recognition is coming to a compatible Windows 10 laptop, as a part of NAB technology initiatives in 2021.

“Employees would be able to enjoy almost instant login using facial recognition, both increasing security on devices and also providing a more convenient and faster login experience.”

NAB had trialed facial recognition for ATM access in the pre-covid days with Microsoft.

Although the initiative didn’t lead to any implementation, NAB’s technology partnership with Microsoft is going strong – NAB announced a five-year partnership with Microsoft in its Cloud journey embracing the multi-cloud paradigm.

Auto-Pilot to reduce dependency on IT Support

Aimed at improving employee experience, Auto-pilot essentially cuts out the need for IT to touch a new laptop before it’s delivered. The tech team would be shipping new PCs to new starters directly.

The entire set up process then takes place over the Cloud (online) — ordering, software setup, updates, and issues resolution are all done remotely and immediately, through Auto-pilot.

Also read: U, V or W? Economic recovery uncertain: NAB CEO

NAB Technology initiatives aimed at Improving Customer Experience

Branch Banking Model making way to Online amid the pandemic

In the COVID economy, NAB digital strategy has accelerated the shift from in-person banking to Online banking. Deploying digital tools to support banking in the new world, NAB announced small regional branches would be open only from 9.30 am until 12.30 pm. All support outside this period would be via digital and phone banking.

The bank revealed key statistics supporting the shift:

- Over 90% of NAB’s customer interactions are now taking place online or by phone

- More than 50% of customers log into NAB digital banking via the app or online

- Over-the-counter transactions have reduced by 25 per cent in the past year

Read more at NAB Digital Strategy Accelerates Branch Model Change

NAB Technology launches key Digital Features

In his first appearance after taking over as the CEO, Mr McEwan listed five focus areas for NAB in December 2019. In line with this strategy, NAB announced a range of digital initiatives aimed at improving customer experience:

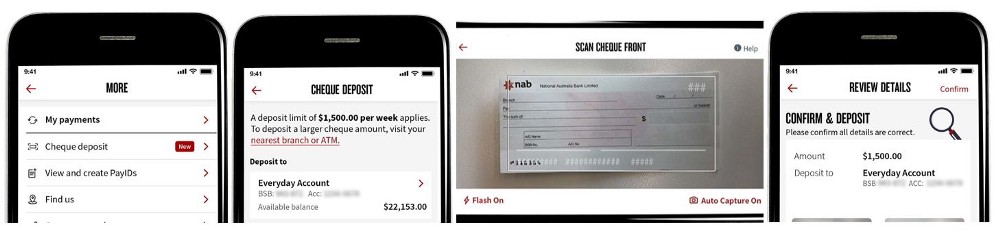

Online cheque deposit

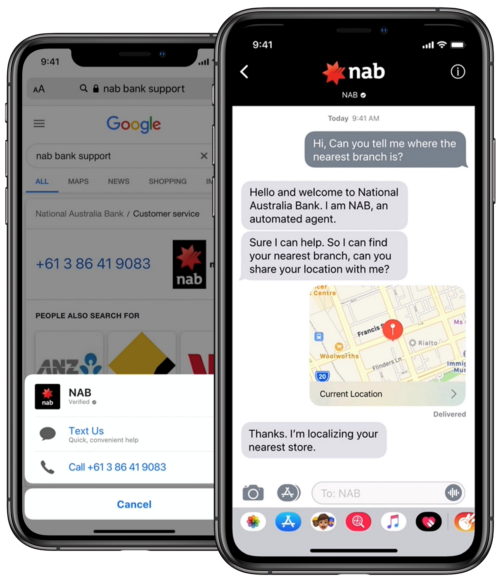

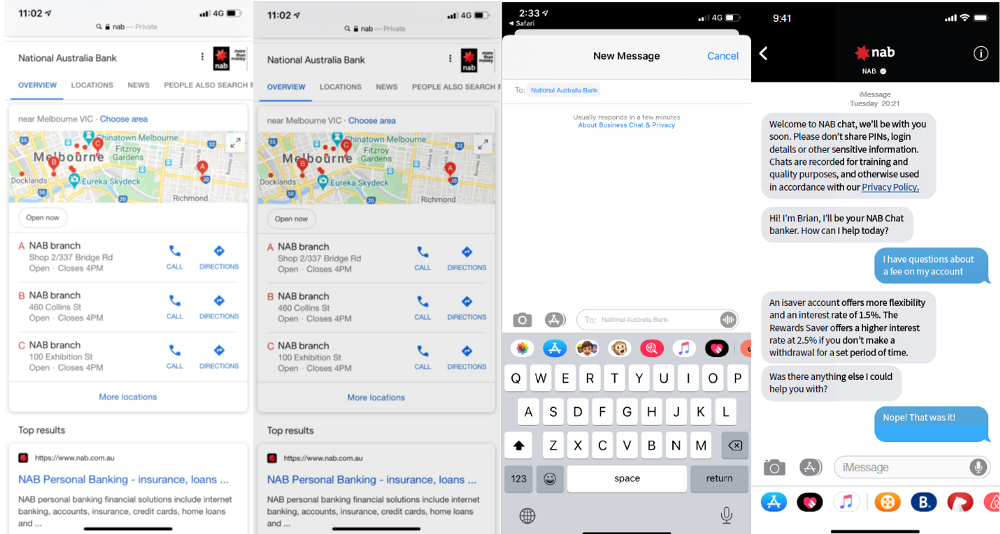

iMessage Chat Support

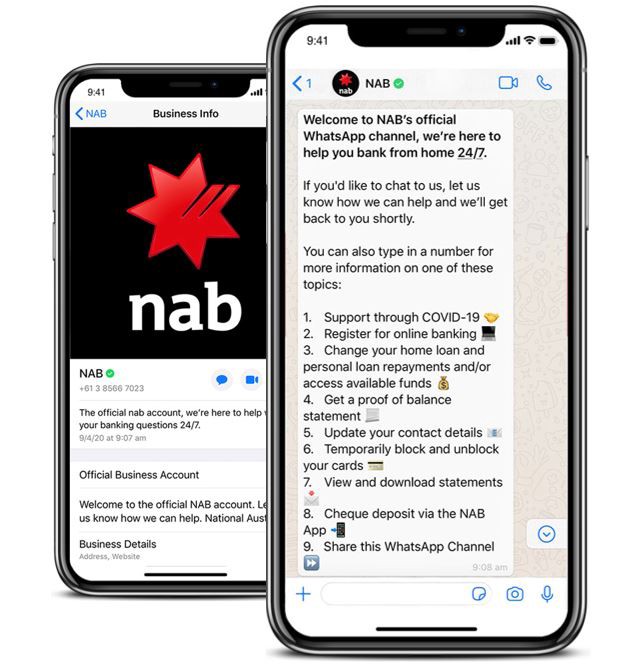

Whatsapp chat support

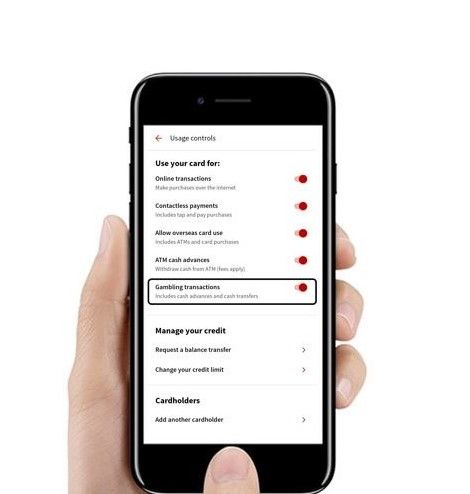

Digital option to restrict gambling transactions

Check out this video on Voice ID Biometrics market significance

Voice ID biometrics to improve contact centre experience

NAB digital strategy targets 250,000 customer enrolments for its VoiceID biometrics authentication. As the first major Australian bank to launch Voice ID Authentication, NAB said the feature is aimed at improving customer experience.

Partnership with Pollinate

As the largest lender to small and medium businesses, the Melbourne-based big bank carries the highest risk due to COVID economic pressures.

Aimed at bringing new insights and savings to small businesses, NAB announced a partnership with Pollinate becoming the second bank to partner with Pollinate.

NAB said it’s targeting a pilot in March 2021 ahead of rolling out the technology across its customer network.