Australian fintech leaders Zip Co and 86 400 announced a partnership to accelerate change in the industry. The partnership between the two disruptive players aims to tap into the growing trend of Australians looking for smarter, fairer digital alternatives.

With its connected accounts feature, 86 400 provides clients with the option to view their accounts from over 100 institutions within its app giving customers full visibility of their financial picture.

With the Zip partnership, the challenger bank’s customers can link and view their Zip Pay and Zip Money accounts, enabling transactions and balances to be seen within the bank’s app.

Also read: Digital Banking: Market shifts towards AI, cloud and secure banking

Zip and 86 400 are like-minded, purpose-driven businesses. We were both built to give Australians better experiences with their money, and so by working together, we can accelerate our shared mission

Robert Bell, CEO 86 400

Data is central to our decision-making: ANZ Bank

86 400 raised $34 million funding in early April backed by top tier investors. The investment demonstrated the confidence of leading investors in the disruptive play by the Australian fintech players including 86 400.

The neobank had announced it could hit 500,000 accounts in the next 12 months. “We anticipate having a mortgage book of close to $2bn by the end of 2021,” said Mr Bell.

Also Read: NAB leverages Human-Centric Design to expand Data and Analytics Guild

Klarna, the leading payments provider and shopping service, announced reaching 7.85 million customers in the US.

The buy-now-pay-later sector has witnessed significant growth with its disruptive value proposition. In a recognition of its growing influence, Commonwealth Bank announced a partnership with Klarna for Australian business.

Afterpay extended its reach to 5 million active users in the US while its challenger Openpay announced securing funding of about A$30 million to accelerate growth in UK and Australian markets.

Also read: Westpac compliance failures blamed on technology and human error

Fintech disruption

Basic banking services with attractive rates and high availability is a compelling value proposition the big banks could find difficult to match. So the established banks have been adding new features to their current services.

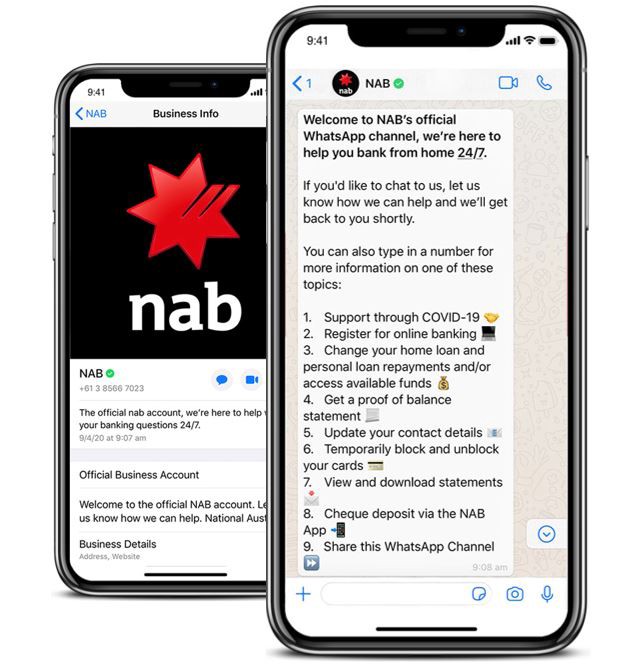

National Australia Bank recently launched new digital support features aimed at improving customer experience. This comes after the recent announcement of a digital feature to restrict gambling transactions on its app.

NAB targets 250,000 customer enrolments for its Voice ID biometrics

Commonwealth Bank has been on a transformational journey leveraging technology to deliver better banking services via its app.

In yet another reminder of the disruption by the neobanks, Bank of Queensland announced its aims to become a neobank focusing on delivering digital services aggressively with a 5-year Capex investment of $440mn.

While the big banks have been grappling with the after-effects of the Banking commission report, the neobanks are not only entirely digital but also offering Australians the best way to save money.

Appealing to the so-called Millenials and digitally savvy customers, the challenger banks have shown a lot of promise gaining customers’ as well as investors’ confidence.

The Zip-86 400 partnership is a reflection of that promise and the dawn of a new reality. The big banks better watch out!

Also read:

- NAB 1H20 Results Analysis: Focus on Digital Transformation, Cloud First Agenda, Employee Upskilling, Strategic Insourcing

- ANZ Group promotes Emma Gray as Group Executive, Data & Automation

- Technology sector remains confident, continues to eye M&A as a strategic tool: EY

- Slack strikes multi-year partnership with AWS