Announcing FY20 results, CBA advanced digital plans with simplification agenda targeting over 95% on cloud in 5-7 years. Revealing its six focus areas to “extend digital leadership”, the big bank committed to simplify and reduce app footprint.

CEO Matt Comyn said: “We came into the challenging period in a very strong position, but we have been impacted”. The bank reported cash net profit after tax was down 11% on the previous year.

Focus on Technology with Simplification Agenda

Today’s announcement is a reiteration of the earlier guideline to move about 95% on cloud with an aim to “simplify the bank”.

The Simplify technology initiative focuses on a “simplified IT architecture and reduce the unit costs of technology”.

The goal is to make it simple for customers to bank with CBA delivering digitisation benefits. To this effect, CBA has partnered with leading global players including Microsoft.

Planning to reduce the number of apps running on “too much infrastructure”, CBA had earlier this year announced to reduce the footprint by 25%.

IT expenses increased due to higher IT Infrastructure costs and higher spend on risk and compliance. It is not clear why the IT infrastructure costs have increased as the bank has announced a shift to cloud amid increased digitisation.

Also read: CBA announces strategic partnerships to offer new digital services

The 6 areas of focus to extend CBA’s “digital leadership”

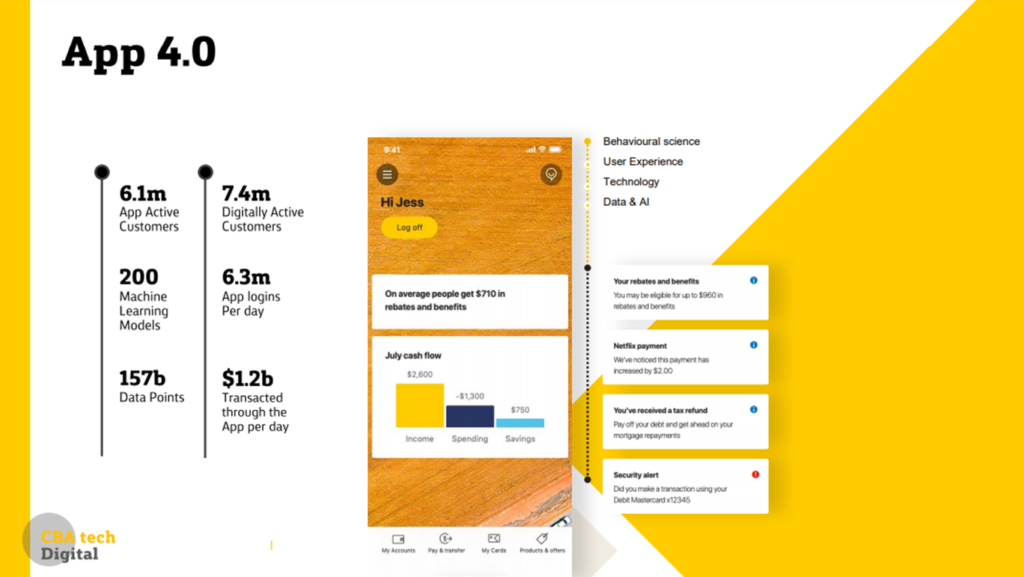

- Personalisation

- Integrated Digital Experiences

- Digitising end-to-end

- Intelligent Protection

- Resilient, modern platforms

- Globally leading capability

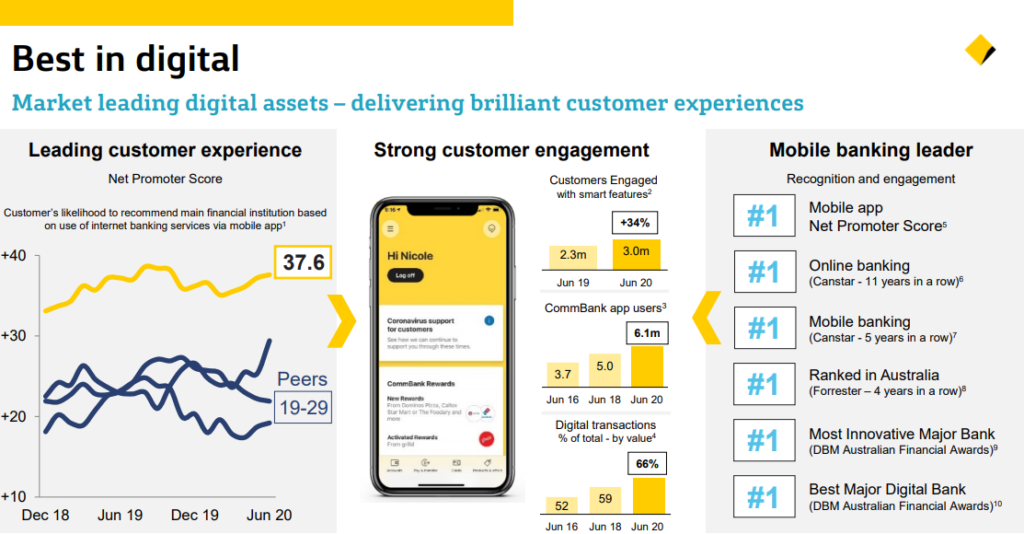

Forrester names CBA the leader in Australian mobile banking

Forrester’s latest report on Australian Mobile Banking apps has rated the CommBank app as the overall leader in digital experience for the fourth consecutive year.

The report states, “CBA takes the lead by delivering impressive digital experiences, excelling at both user experience and functionality.”

For the fourth year running, CommBank takes the lead by delivering impressive digital experiences, excelling at both user experience and functionality.

The Future of Digital Banking

Recent Ovum report on Digital Banking noted “market shifting towards AI, cloud and secure banking“.

The latest Temenos-sponsored survey interviewing over 300 banking executives revealed the top three trends shaping the future of digital banking. Cloud, SaaS and the game-changing AI are the key trends to watch out for in the banking sector.

The Temenos-EIU survey noted, “Of all advanced technologies, banking leaders strongly believe (77%) that Artificial Intelligence (AI) will be the most game-changing“.

Bankers see a diverse range of uses for AI with “customer experience through personalisation” as a top priority.

The CBA strategy seems to be aligned with the trends shaping the industry.