Announcing the bank’s full-year result for 2022, ANZ Group CEO Shayne Elliott revealed that ANZ Plus will be launching a digital home loan pilot, a “truly digital” end-to-end solution from application all the way through to settlement.

“The rebuild of the technology platform and the rollout of ANZ Plus continues apace”.

Calling it the “world’s best technology available today”, Mr Elliott said “All the backend banking technology is new and it’s performing extraordinarily well. We can see that in the hundred-odd metrics we measure every day.

“It’s important to note it’s not just about the technology. It’s really a new business model built around this idea of (our customers’) financial well-being.” He also emphasised the need to recruit and retain talent.

“We need to be able to hire the very best technology people, apply the very best technology”.

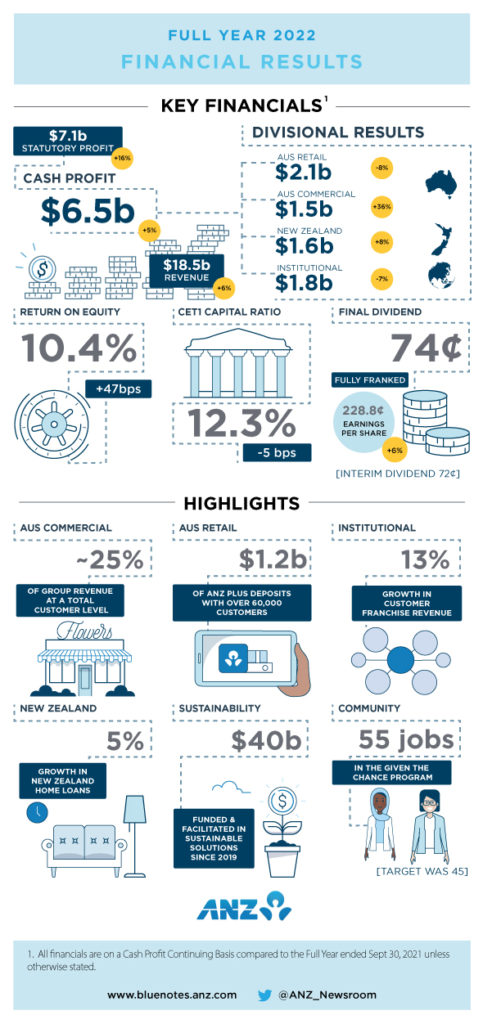

ANZ Plus also recently become the fastest new digital bank in Australia to reach $A1 billion in deposits.

Related read: ANZ’s Algorithm Helps Fintel Alliance Combat Money Laundering

“Truly Digital” Home Loan: To reduce decision time from days to minutes with 80 per cent reduction in manual verification

ANZ’s Customer Experience Lead Peter Dalton said “Home loan strategy will follow, which will assist clients in acquiring home ownership more quickly.

We want to cut the time to a decision for potential homeowners from days to minutes.

ANZ will be going into a beta test with staff before the end of the year with the initial home lending offering launching to the market later in 2023.

This would involve an 80 per cent reduction in manual verification.

“While there is much still to do, we feel we have the right foundations in place to continue to build a new retail bank – without the constraints of legacy technology and focus on the financial well-being of our customers.”

Related read: ANZ Bank exploring Digital Currencies, DeFi and Tokenisation: Chairman

Four Key Focus and Priority Areas for ANZ Group:

CEO Shayne Elliott recently identified four key areas of business strategy:

- Creating propositions our customers love

- Building platforms that give us opportunities to scale

- Looking for partnerships in an increasingly digital world and

- Focusing on the importance of our people and our purpose

ANZ Group Technology Priority Is To Align With Business Strategy: CIO

Group Technology Executive Gerard Florian said the highest priority of the technology function is to “line up with where the business wants to get to”.

Historically not everyone has been always happy with some of their experiences. One area we’ve also focused on is doing a better job of convincing the business of the relevance of technology.

We’ve got a clear plan for Cloud Migration and are well into the process of migrating our technology estate to the Cloud.