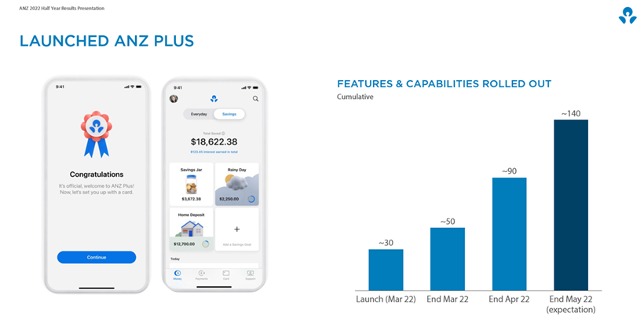

ANZ Group said is building its digital capability and functionality, taking a modular approach to improving customer experience. Technology Executives Tim Hogarth and Wayne Spiteri praised the efforts of the ANZ Plus engineering team in building over 100 new features and improvements.

The benefits of the new tech stack powering ANZ Plus are apparent, claim Tim and Wayne.

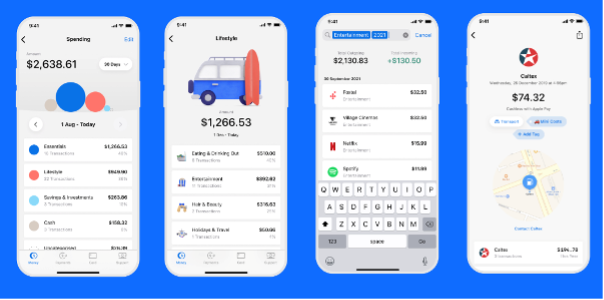

It centres on how we deliver data and insights to the customer. Isn’t this something every Bank does? But ANZ execs claim the ANZ Plus app does it in a very different way – “a way we believe will generate enduring value”.

As self-service has moved from transactional to informational, customers want to better understand their financial data. ANZ notes the traditional banking tech isn’t designed for “always-on banking: whereas ANZ Plus has a different approach.

Also read: Ten Years Of Change In 10 Weeks: ANZ CIO summarises COVID response

“This meant customer-centric design, engineering and a new tech stack starting with the ANZ Plus iOS app.

ANZ Plus has a different architecture where customer banking data is loaded onto the phone, using very minimal phone storage. It happens in the background rather than when you log in (because, once you’ve logged in, the phone is authenticated with your biometrics so it can safely be stored).”

Also read: Data is central to our decision-making: ANZ Bank

“Banking has moved from the transactional to the informational and it’s only with a rethink of the architecture that we can truly meet future customer needs”

Transactions are stored on the phone which means ANZ Plus can do things some other banks can’t. Customers can search, organise, categorise, tag, group, aggregate, summarise and filter – almost all while offline.

The power of storing the transactions safely on the phone means customers don’t have to log in to see transactions, don’t need an internet connection to see a transaction and don’t need external bank infrastructure to see what they spent today or yesterday.

One can only hope ANZ Plus lives up to the expectations of the millennial cloud-native mobile-banking customer.