Combining Group Operations and Technology Westpac announced creating a new Group Operating Office, appointing Scott Collary to lead the new division as Chief Operating Officer (COO). Mr Collary is due to commence his role later this year, subject to regulatory approvals.

A banking industry veteran, Mr Collary joins Westpac from Bank of Montreal in Canada where he held the role of Chief Information and Operations Officer. Prior to this, he was CIO at ANZ and Chairman of ANZ Operations and Technology.

CEO Mr Peter King, said: “We look forward to Scott leading our technology and operations teams”.

Back in May, Westpac announced the departure of Group Chief Information Officer (CIO) Craig Bright. Mr Bright’s last day with the bank will be 25 September, at which point Mr Thursby will act as CIO until Mr Collary commences, noted the media release.

The Digital Imperative

Backbase’s latest report on digital banking estimates three in five are likely to use digital banking by neobanks and challenger banks by 2025.

In an industry disrupted by Fintech and Big Tech, established players are gearing up to deliver on ever-increasing customer expectations.

The big four banks have been adding new features to their digital services improving upon their value propositions.

Earlier this month, Westpac announced rolling out SD-WAN across branches aiming to improve customer experience and employee experience at bank branches. Started before COVID, Westpac stated the program aims to deliver better digital and technology services in the branches.

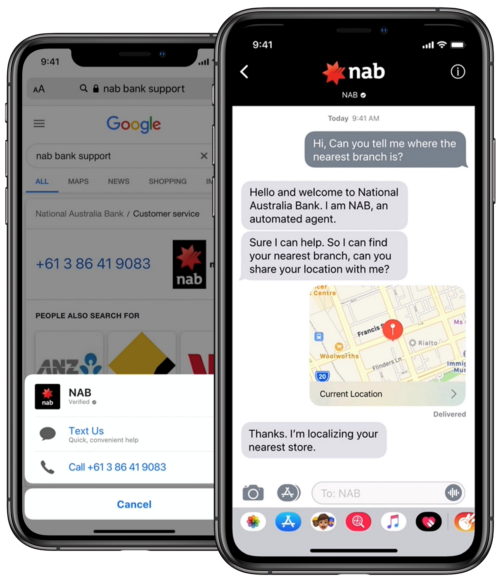

NAB launches new digital support features

Commonwealth bank has been the leader of the pack, recognised by Forrester for delivering the best overall digital mobile banking experience. The Bank of Queensland unveiled its refreshed digital strategy supported by capital ingestion of about $440 mn aiming to become a neobank.

Melbourne based big banks ANZ and NAB have been enhancing their digital strategies.

NAB added a range of digital features aimed at improving customer experience including iMessage and Whatsapp support, cheque deposit feature online, Voice ID biometrics among others.

NAB provides digital option to restrict gambling transactions

Forrester in its latest report on Australian mobile banking apps has rated the big four banks on delivering basic banking functionalities. Rating Commbank as the number one in overall digital experience, the research firm asked the big banks to not just meet but also anticipate customer needs. Read more about the review here.