Dr Andrew McMullan, the Chief Data and Analytics Officer of CBA said the bank’s Customer Engagement Engine (CEE) – powered by artificial intelligence – was one of the key tools CBA was using to better understand its customers to deliver personalised experiences.

“Our Customer Engagement Engine makes over 35 million decisions every single day.

Looking into the future, we want to ensure every single one of those decisions is better and more personal.

We want to continue to use our technology to better understand our customers and make the future brighter for every individual,” Dr McMullan said.

Since it was first implemented, the CEE has helped to significantly transform the way the bank interacts with customers, noted Dr McMullan.

Built on a Pegasystems stack, CBA’s Customer engagement engine was designed to have proactive, needs-based conversations with customers, revealed Dr Andrew McMullan.

First deployed across the branch network some years ago, the engine has been dialled up significantly in recent years and is now integrated across all the bank’s key channels.

As a result, the bank can now provide a range of important real-time information and support to customers thanks to the CEE, claimed Dr McMullan.

Further, the bank has been able to leverage its CEE and AI capabilities to detect and prevent abusive behaviours in transaction descriptions.

In 2021, CBA became one of the first banks to develop a new AI model that can proactively identify instances of technology-facilitated abuse, a targeted form of domestic and family violence.

The AI model complements the bank’s automatic block filter that was implemented in 2020 across its digital banking channels to stop transaction descriptions that include threatening, harassing or abusive language.

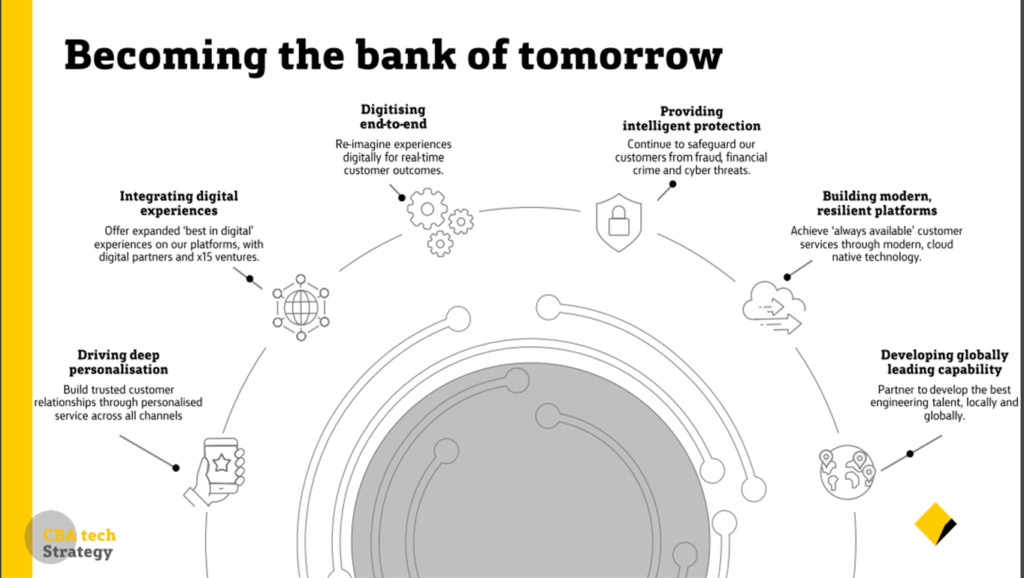

For more on CBA’s digital strategy visit here

ANZ Group also has technologies implemented to detect and prevent abusive behaviours in transaction descriptions. Deploying Behavioural Biometrics in digital channels the big bank noted the technology is helping to fight fraud with real-time fraud detection capabilities.

Partnering with AUSTRAC, ANZ Group also revealed its algorithm is helping the FinTel alliance combat money laundering. For more details check out the report here.