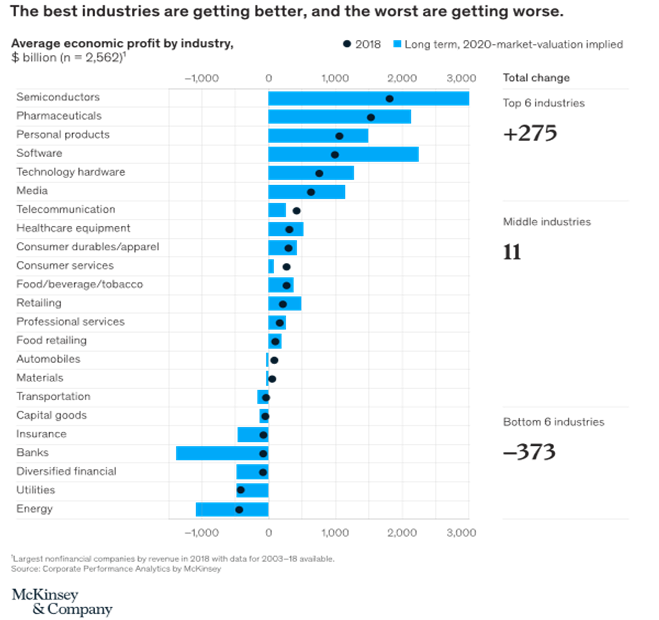

The six best-performing industries, including semiconductors, pharmaceuticals, and software, have added $275 billion a year to their expected economic-profit pool, while the least profitable six—including insurance, utilities, and energy—have lost $373 billion, according to the latest research by McKinsey.

The McKinsey research found that companies that pursued big strategic moves persistently, through every phase of the economic cycle, increased their odds of outperforming their peers.

The COVID-19 crisis has intensified existing trends, widening the gap between those at the top and bottom of the power curve of economic profit.

Ten Years Of Change In 10 Weeks: ANZ CIO summarises COVID response

Fault-lines have become fissures amid the pandemic. The economic shock has accelerated and intensified trends that were already underway.

The result is a dramatic widening of the gap between those at the top and the bottom of the power curve of economic profit —the winners and losers in the global corporate-performance race.

Much of the organizational inertia that usually stands in the way of unlocking these big moves is now gone, as the crisis has rendered obsolete the budgets and personal targets that make such moves so hard to achieve.

U, V or W? Economic recovery uncertain: NAB CEO

Unique opportunity

Despite the challenges, the crisis offers a unique window of opportunity. The top quintile enterprises are seizing the opportunity

- Manufacturers of some hygiene-related products are aggressively expanding production capacity for the coming year.

- Pharmaceutical companies are reinventing their systems to accommodate soaring demand.

- High-tech players are acquiring missing elements of their future ecosystems.

- E-commerce leaders are unleashing massive through-cycle spending on infrastructure, capacity, and even brand-portfolio expansion.

For companies with middling performance, this is a call to action. Some enterprises are giving the go-ahead for the large digital- and analytics-transformation programs they had been slower to commit to under pre-pandemic conditions.

A recent report by Cisco company Appdynamics revealed digital transformation projects which would typically take more than a year for approval in the pre-pandemic days have been approved in a matter of weeks amid the pandemic.