Distributed Ledger Technology can help safely and efficiently share data, process claims and prevent fraud in the insurance industry. Implementation of Blockchain is still in the early stages, according to Infiniti Research.

“Not only does blockchain offer the promise of cost reduction and efficiency, but it could also enable revenue growth, as insurers attract new business through higher-quality service,” says an insurance industry expert at Infiniti Research.

Blockchain offers the promise of cost reduction and efficiency. Higher-quality service and the aspect of self-management help insurers attract new businesses.

The applications of blockchain in insurance are expected to revamp the way the insurance industry functions

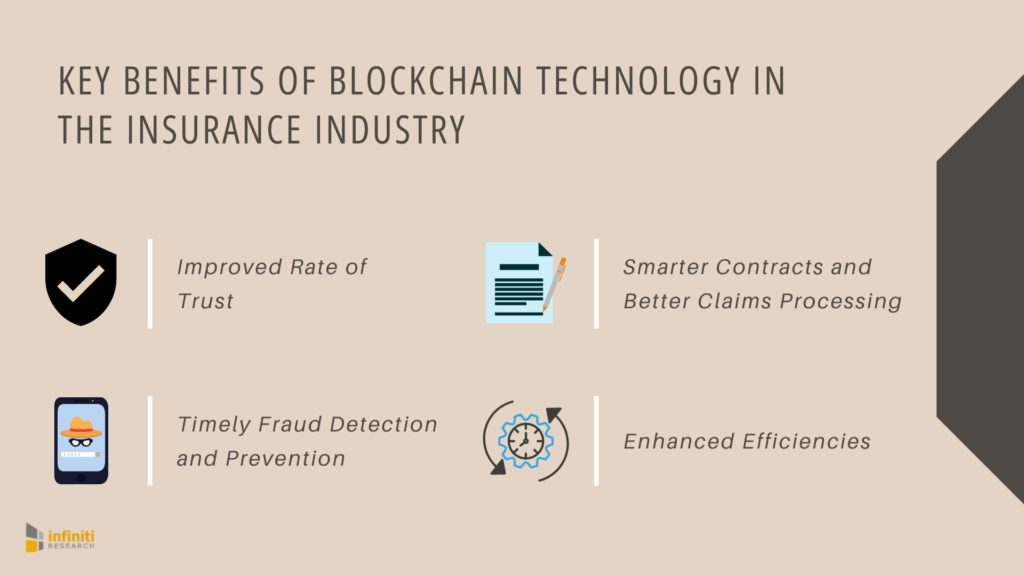

Infiniti’s experts identified the following four benefits of blockchain in the insurance industry:

- Provides transparency in transactions and helps build trust

- Helps to verify customers, policies, and transactions easily, and prevent fraud

- Smart contracts and blockchain technology help insurers and the insured manage claims responsively and transparently

- Blockchain drives security and efficiency and allows individuals to control their personal data while the verification is registered on the blockchain

Also read: Enterprise spending on AI will double in four years, says IDC

There’s a lot of work to be done by the insurance players in working out the best path ahead. Distributed ledger technology has huge potential but is this the solution the insurance industry is looking for? The jury is still out on the subject.